TUSCALOOSA, Ala. — Business confidence among Alabama’s industry leaders remains high heading into the final quarter of 2017, according to a recent report from The University of Alabama.

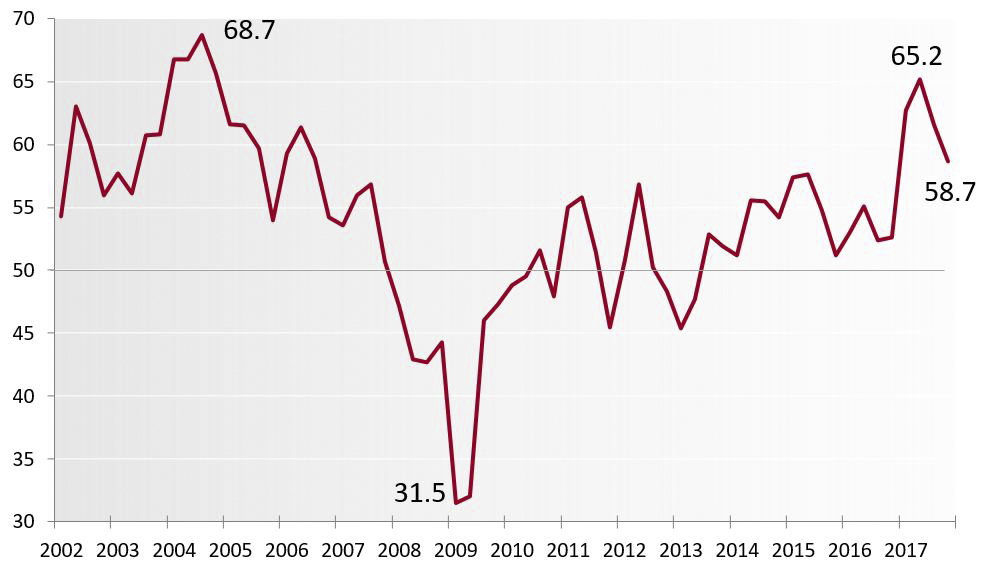

The Alabama Business Confidence Index, a quarterly survey of statewide business sentiment by the Center for Business and Economic Research in UA’s Culverhouse College of Commerce, showed a slight dip in statewide business confidence, from 61.6 to 58.7, but the overall index score remains nearly five points higher than the previous five-year average.

The index reached 65.2 for the second quarter of 2017.

Business confidence in Mobile was the highest of the state’s four metro areas – which also includes Montgomery, Huntsville, and Birmingham – with an index score of 62. All four metro areas registered a “positive” outlook, though Birmingham leaders’ confidence slipped 4.3 points to 54.8.

CBER polls business leaders across the state each quarter specifically about the upcoming quarter compared to the current quarter. Questions focus on a range of topics, like expectations for sales, profits and hiring in respondents’ respective industries. Each component index has five response options, ranging from “much worse” to “much better.”

Economic development agencies, local governments and chambers of commerce use the ABCI to keep a pulse of what business leaders are thinking, said Susannah Robichaux, UA socioeconomic analyst for the Center for Business and Economic Research, known as CBER.

“Montgomery had the highest ABCI last quarter, and their Mayor (Todd Strange) lauded the report in a statement about area startups,” Robichaux said. “But even when the numbers aren’t positive, the ABCI helps them understand how their business leaders are feeling and what they can do to help drive up confidence.”

Leigh Perry-Herndon, vice president of marketing and communications for the Mobile Area Chamber of Commerce, said the quarterly report is shared internally with key investors and during the Chamber’s annual “State of the Economy” event each December.

The report is one of several tools its economic development team uses to align with projects at various stages of development. In many cases, ongoing industry recruitment or projects that have recently broken ground move the needle before the news reaches the rest of the state, Perry-Herndon said.

“We started working on the ThyssenKrupp (now AM/NS Calvert) facility in 2005, and it opened in 2009,” Perry-Herndon said. “But two years into it, with nearly 10,000 construction jobs associated with it, we started seeing our area confidence grow in the business leader confidence index.

“So what you’re seeing now, based on the survey and the current levels of confidence in our area, mirrors that process with projects that are starting to turn over.”

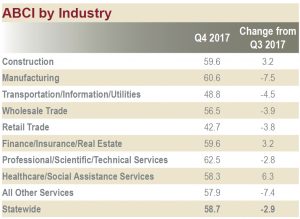

Confidence in professional, scientific and professional services registered a 62.5, the highest among the ABCI’s 10 industries.

Mobile’s evolving industry landscape and recruiting efforts have shifted from steel to aerospace to logistics and transportation distribution over the last 10 years, Perry-Herndon said. The fluidity can also affect quarterly confidence in sales, profits, hiring and capital spending in a number of industries, as manufacturing confidence dropped significantly, from 68.1 to 60.6.

Business leaders are least confidence in retail trade, which continues to dip – down to 42.7 this quarter.

Contact

David Miller, communications, 205-348-0825, david.c.miller@ua.edu

Source

Susannah Robichaux, 205-348-3781, scrobichaux@cba.ua.edu